Raquel G. Roque

Lawyer - Corporate & Tax Law

Apr 9, 2024

Your comprehensive guide to understanding taxes in Portugal

As you take your first steps toward embracing the charm of Portugal, it's worth glancing beyond the sun-drenched shores and mosaic streets to understand a crucial aspect of your new journey: taxes in Portugal. Fear not, we're here to guide you through the maze of Portuguese taxation – without losing you in a sea of numbers and forms.

From the personal income tax (IRS) that employees see deducted from their pay-checks every month, to the value-added tax (VAT) on goods and services, and even the single circulation tax that you pay annually if you own a car, there are several taxes in Portugal to which people and companies are subject. By the end of this article, you'll find yourself much better equipped to navigate taxes in Portugal.

What are all the taxes in Portugal to consider?

Navigating the intricate taxation landscape in Portugal can indeed be a complex endeavor, given the multitude of taxes in place.

As the Portuguese tax system continually evolves, it can be challenging to stay updated, and many of us have experienced the feeling of being overwhelmed by the sheer volume of available information.

That is why we created this article. Our purpose is to provide clarity by outlining the types of taxes in Portugal and how they operate on the national, regional, and local levels.

Taxation in Portugal is divided into three main categories.

- Income, which covers earnings from various sources like employment, self-employment, and investments.

- Consumption, which includes taxes applied to goods and services at different rates.

- Assets, which consist of taxes related to property and other valuable possessions.

Income Taxes in Portugal

In Portugal, taxes are applied to two main areas: the money that individuals earn, known as Personal Income Tax (IRS), and the profits companies make, called Corporate Income Tax (IRC).

To understand how income taxes work in Portugal, let's look at Personal Income Tax (IRS) for individuals and the different ways taxes are collected.

Personal Income Tax (Imposto sobre o Rendimento de Pessoas Singulares - IRS)

Portugal's Personal Income Tax encompasses a wide range of income types and is collected through several methods, each tailored to different categories of income.

There are six categories of income subject to IRS:

- Income from dependent work (employed positions)

- Business and professional income (e.g., self-employment)

- Capital income

- Property income

- Increases in assets (capital gains)

- Pensions

The IRS employs a progressive tax structure, which means that the higher your income, the higher taxes you will have to pay. The Portuguese government employs three primary methods for tax collection for IRS:

1. Taxation by Aggregation

This approach involves combining income from various categories. For some of those income types, it’s mandatory to combine them and pay taxes on them as a whole, and for other categories it’s up to the taxpayer whether to aggregate or not. When aggregating different income types, their combined value is subject to the same personal income tax rates, regardless of the source of income.

For example, income sources like salaries or pensions are mandatory to combine and undergo taxation as a whole. In contrast, revenue from rentals could be independently taxed, although individuals have the option to choose taxation by aggregation if preferred.

The income types subject to taxation by aggregation:

- Dependent work

- Self-employment

- Pensions (with some exceptions)

- Some increases in assets (capital gains)

2. Taxation by Rates in Full Discharge of Tax Liability

This method involves applying predefined tax withholding rates at the moment the income is made available to the taxpayer. The financial institutions responsible for distributing income administer these rates. This approach ensures that the tax owed is fully taken care of, right when the income is received.

The income types subject to taxation by rates in full discharge of tax liability are:

- Capital income (e.g., interest from a bank savings account)

- Most instances of capital gains (that is, increases in assets)

3. Taxation at Special Rates

Similar to taxation with rates in full discharge of tax liability, this is an individual-based approach, this means each category of income to which this applies is treated separately. However, in this scenario, although you can have the tax withheld when you receive the income, the income is taxed with a flat tax rate, instead of the common progressive tax scale applicable over the majority of incomes like dependent, self-employed or pensions.

The income types subject to taxation at special rates:

- Property income (e.g., rental income at 28% or lower)

- Some increases in assets

In addition to your income, deductions and rebates play a significant role in tax calculations. The Personal Income Tax Code offers two types of deductions:

- Deductions from income: these reduce the total taxable income on which you are assessed for income tax. By reducing your taxable income, you effectively lower the amount of income subject to taxation, potentially reducing your overall tax liability.

- Deductions from the tax payable: these are applied after your taxable income has been calculated and your tax liability has been determined. These deductions directly reduce the amount of tax you owe. These include expenses related to health, education, housing, care homes, and child support, as well as general family expenses. Donations and contributions to pension funds and Retirement Savings Plans (RSPs) are also deductible. If you have dependents or low-income elderly family members living with you, you can benefit from automatic deductions. Deductions from the tax payable provide a dollar-for-dollar reduction in your tax liability, making them a valuable tool for minimizing your tax burden.

The calculation of Taxable Income in Portugal depends on factors like income category, marital status, family composition and others.

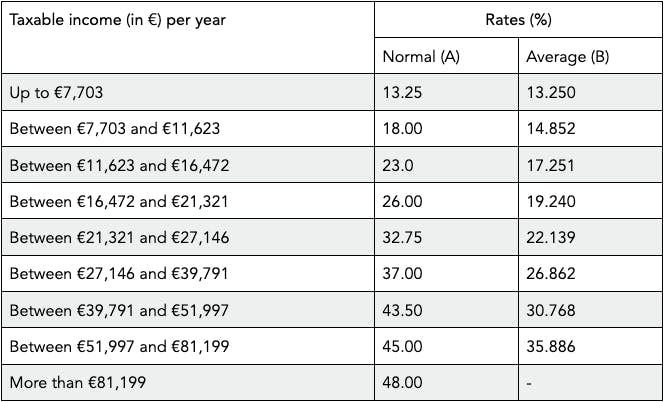

For the year 2024, Portugal established the following tax brackets:

When your income goes beyond € 7.703 it's split into two parts. The first part, up to the highest limit of a specific tax bracket, is taxed at a certain rate (column B). The extra part, the amount above that limit, gets taxed at a different rate (column A) for the next higher bracket.

Example:

With income deductions accounted for, Philip's taxable income settles at €75,000. To ascertain the applicable IRS rates, Philip must pinpoint the bracket that fully covers his income. In this instance, he falls within the seventh bracket, spanning from €39,791 to €51,997.

Here's the breakdown:

- 1st part of income:

€51,997 x 30.768% (average rate of the seventh bracket) = €15,998.44

- 2nd part of income:

Remaining: €75,000 - €51,997 = €23,003

€23,003 x 45.00% (standard rate of the next bracket) = €10,351,85

Adding these amounts (€15,998.44 + €10,351,85) totals €26,349.79, representing the collection, or the tax payable to the Government based on his income.

Subsequently, from Philip's collection, the Tax Authority deducts eligible expenses (like general family and health expenses) and any withholding tax paid throughout the year, if applicable. The outcome is the potential IRS amount he could either owe or be reimbursed by it.

Certain types of income are exempt from personal income tax due to either being taxed under different categories or due to specific tax policies. Incomes that are not subject to income tax include:

- Wages and pensions below €10,694.46;

- Unemployment benefits;

- Sick leave payments;

- Lottery prizes;

- Literary, artistic, and scientific prizes;

- Food and per diem allowances, but up to certain limits, which depends on the circumstances and method of payment. For example, for food/meal allowance, for it to be exempt from personal income tax (IRS), if it's paid together with the salary, via bank transfer, the maximum amount is €6/day, if it's paid via a meal card (it's like a debit card that only works in restaurants and supermarkets), the maximum is €9,60/day. Companies are free to give higher or lower amounts but if it's above these limits, the portion above the limit is subject to IRS;

- Compensation resulting from personal injury, illness, or death.

Should couples choose to file taxes together or separately?

Spouses and unmarried partners have the option to file their annual tax return together, and this may or may not be advantageous, depending on their specific financial situation, income sources, and expenses.

When there's a significant income difference between partners, joint taxation often makes sense. It helps balance the tax burden, as lower-earning individuals can offset some of the tax liability of higher-earning partners. In this situation, opting for joint taxation usually results in a lower combined tax bill compared to what each person would pay individually, this is due to the progressive nature of the IRS.

Couples, whether married or unmarried, are not obliged to file their tax returns jointly or separately. Each year, they can choose the option that is most advantageous to their financial circumstances. And the following year they can change their option.

Tax incentives for individuals

For non-residents in the past 5 years, that become tax residents from 2024 and on, there are some tax benefits, such as tax incentive for scientific research and innovation, that applies to activities related to:

- Teaching in higher education and scientific research;

- Qualified jobs and members of corporate bodies within the scope of contractual benefits for productive investment in accordance with the Investment Tax Code;

- Highly qualified professions defined by ordinance carried out in:

- Companies with relevant applications that benefit or have benefited from the investment support tax regime; or

- Industrial and service companies, whose main activity corresponds to an economic code defined by ordinance, and which export at least 50% of their turnover, in the year in which they start their duties or in any of the two previous financial years.

- Other qualified jobs and members of governing bodies, in entities carrying out economic activities recognized by AICEP, EPE, or IAPMEI, IP, as relevant to the national economy;

- Research and development jobs, for staff with a doctorate, whose costs are eligible for the purposes of the Tax Incentive System for Business Research and Development (SIFIDE);

- Jobs and members of governing bodies in entities certified as start-ups;

- Jobs or other activities carried out by tax residents in the Autonomous Regions of the Azores and Madeira, under the terms to be defined by regional legislative decree.

Taxpayers who meet the requirements may be taxed at a special IRS rate of 20% on net income earned from the above activities, for a period of 10 consecutive years from the year of their registration as a resident in Portuguese territory.

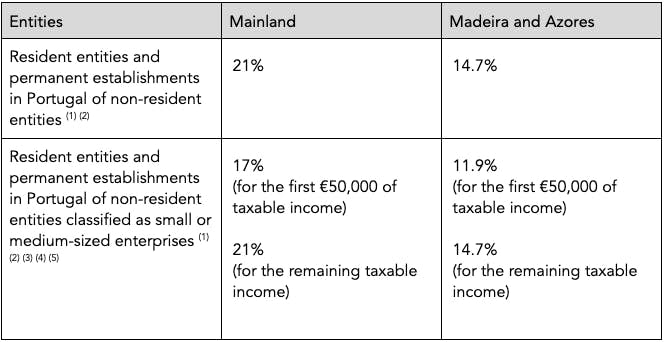

Corporate income tax (Imposto sobre o Rendimento de Pessoas Coletivas - IRC)

IRC is a tax that applies to the earnings of legal entities. This includes commercial or civil companies operating in a commercial capacity, cooperatives, public corporations, and other legal entities of a public or private nature headquartered inPortugal.

Additionally, IRC encompasses entities whose income falls beyond the scope of IRS taxation. For instance, this category extends to cases like unaccepted inheritances (those not yet taken or relinquished to the State) and associations, as well as civil societies lacking legal personality, meaning the entity incorporation documents that have not been registered.

The annual IRC declaration (Model 22) for the income of the previous year must be submitted by May 31st (for entities with a tax period aligning with the calendar year). There are specific deadlines for fulfilling payments on account, which involve making advance payments of income tax.

Consumption Taxes in Portugal

These taxes come into play when a product or service is purchased or consumed, and it is added to its commercial value. Generally, these taxes are already added to the consumer's payment.

Value Added Tax (VAT in English / Imposto sobre o Valor Acrescentado - IVA)

VAT is levied on the consumer upon buying a product or service, with the seller or service provider subsequently forwarding this amount to the Tax and Customs Authority (AT).

VAT comprises three rates: standard, intermediate, and reduced. As of 2023, the rates stand as follows:

Certain services, like those offered by healthcare professionals, nurseries, kindergartens, or non-profit establishments focused on artistic, sporting, or recreational activities, are exempt from VAT under Article 9 of the VAT Code. The same exemption applies to condominium management, standard rental arrangements, and a majority of bank fees/commissions.

For self-employed individuals whose annual revenue doesn't exceed €15,000, there's no obligation to charge this tax.

Vendors or service providers not qualifying for VAT exemption are required to remit it by the 25th of the second month following the relevant month or quarter, based on whether they follow the monthly or quarterly regime.

Tax on Vehicles (Imposto sobre Veículos - ISV)

This tax pertains to vehicle usage and is a one-time payment made during the process of obtaining a Portuguese license plate. It is also applicable if modifications to the engine or chassis are made that could lead to higher taxation.

ISV is primarily calculated based on two factors: engine capacity and emissions. Depending on their categories, vehicles are classified into different brackets that determine the corresponding tax. The Finance Portal provides a simulation tool for estimating the ISV value of a vehicle, though access to the simulator requires authentication.

Note that vehicles lacking engines, those powered by electricity, or utilizing renewable energy sources are exempt from ISV.

Stamp Duty (Imposto do Selo - IS)

A tax that has a broad application, covering a range of scenarios including wills, insurance, rental or purchase agreements, consumer credit transactions, share dealings, and even gambling winnings.

In essence, it is imposed on all actions that are not either subject to or exempt from VAT. The comprehensive stamp duty table provides an overview of situations where this tax is relevant, along with the corresponding rates for each circumstance.

Special Consumption Taxes (Impostos Especiais de Consumo - IEC)

These taxes are for products that pose risks to the environment or public health. This category comprises three distinct taxes:

- Tax on alcohol, alcoholic beverages, and beverages containing added sugar or alternative sweeteners (IABA).

- Tax on petroleum and energy-related products (ISP).

- Tax on tobacco (IT).

Taxes on assets in Portugal

These taxes are imposed on assets, whether simply held or transferred through actions like buying, selling, donating, or inheritance.

Municipal Property Tax (Imposto Municipal sobre Imóveis - IMI)

Property owners pay this tax annually. It's settled by the person, people, or legal entity, on the property’s title on December 31st of the preceding year, with the collected funds going to the local municipality.

IMI is calculated by multiplying the property's Tax Value (Valor Patrimonial Tributário - VPT) with the prevailing rate specific to the municipality. The Tax Value (VPT) is usually lower, and sometimes significantly so, than the property's market value. You can access this value through the property's Caderneta Predial or the Tax Authority Portal.

The IMI rate is established annually by each municipality within the limits laid down by the government:

- Urban Buildings: Range from 0.3% to 0.45% (or up to 0.5% in exceptional cases)

- Rustic Buildings (i.e., land): Up to 0.8%

IMI payments can be made in a single installment (May) if the amount is €100 or less. For payments exceeding €100 but not surpassing €500, it can be paid in two installments (May and November). When the value exceeds €500, it can be settled in three installments (May, August, and November).

Additional to the Municipal Property Tax (Adicional ao Imposto Municipal sobre Imóveis - AIMI)

This tax is imposed on the combined Tax Value (VPT) of residential real estate and land with a construction permit held by each liable entity (be it an individual or legal entity) on January 1st of the relevant year.

Legal entities (i.e. companies) face a uniform rate of 0.4%, applicable to the cumulative VPT total. If the property is for the personal use of the owners of the capital, administrative, management or supervisory bodies, the rates for natural persons apply.

Conversely, for individuals, rates adjust based on the aggregate taxable value as follows:

- 0.7% for VPTs over 600 000 euros up to 1 million euros.

- 1% for VPTs over 1 million up to 2 million euros.

- 1.5% for VPTs exceeding 2 million euros.

Should a couple opt for joint taxation, the values for each bracket double. For instance, the initial bracket extends from one million two hundred thousand euros to two million euros, and the pattern continues.

Payments for AIMI are made once a year, in September.

Municipal Tax on the Transfer of Real Estate (Imposto Municipal sobre as Transmissões Onerosas de Imóveis - IMT)

This constitutes one of the financial considerations when acquiring property, whether new or used, and also applies to property exchanges (known as "permutas" in Portuguese). The revenue generated from IMT is allocated to the local municipality.

IMT's value is calculated based on either the property's purchase price or its Tax Value (VPT), with the higher of the two taken into account. The specific IMT rate is contingent on the property's location and intended use.

As of 2024, the IMT tax rate can reach up to 7.50%, applicable to residential properties on mainland Portugal exceeding €1,050,400. However, properties on the mainland acquired for personal and permanent housing under €101,917 are exempt from this tax.

The IMT payment should be settled before the signing of the purchase and sale contract/deed, and the buyer is required to provide proof of payment. Typically, this payment occurs during the deed meeting, subsequent to the notary, lawyer, or solicitor's confirmation of fulfillment of all other property purchase and sale conditions. At this point, the buyer makes the tax payment – often via their banking app – and provides evidence of payment to be appended to the contract.

Stamp Duty (Imposto do Selo - IS)

While it's categorized as consumption taxes, stamp duty can also be regarded as a tax on assets. This is because it applies not only to the purchase of goods and services but also to donations, inheritances and certain transfers of both movable and immovable property.

Nevertheless, the Stamp Duty Code outlines exemptions, particularly in cases where donations or inheritances occur between spouses or unmarried partners, as well as descendants and ascendants (comprising parents, grandparents, children, and grandchildren).

For instance, in the context of a real estate acquisition, a typical scenario involves a 0.80% stamp duty tax. This is calculated based on either the purchase price or the Tax Value (VPT) of the property, with the higher of these two values taken into consideration – much like the IMT tax.

However, in the case of donations or inheritances, such as receiving a property from an uncle, you would be subject to a 10% stamp duty on the property's tax value (VPT). If you received cash instead, the stamp duty would also be 10% of the cash amount received. Spouses or unmarried partners, descendants and ascendants, are exempt from it. Meaning that in most cases there's no tax charged.

Single Circulation Tax (Imposto Único de Circulação - IUC)

IUC is an annual tax imposed on vehicles registered in Portugal. It doesn't solely encompass passenger, cargo, or multipurpose cars, but also extends to motorcycles, tricycles, quadricycles, boats, and private aircrafts.

The responsibility of IUC payment falls on vehicle owners, financial lessees, purchasers who've reserved ownership, holders of purchase option rights based on a lease agreement, and even heads of households within an undivided inheritance (meaning that it has not yet been shared).

IUC payments are due by the end of the vehicle's registration month.

Rates for IUC are updated annually and vary according to engine capacity, fuel type, and year of registration. These rates can be found in the IUC Code, specifically Article 8 and subsequent sections. Certain vehicles, such as exclusively electric ones or those powered by non-fossil-fuel renewable sources, are exempt from this tax.

Final Thoughts on Taxes in Portugal

As we conclude our exploration of the various categories of taxes in Portugal, we invite you to stay connected. Should any questions, uncertainties, or thoughts arise as you navigate this terrain, our dedicated team at moviinn is here to support you. Your financial journey in Portugal is distinct, and our goal is to empower you with knowledge. Reach out to continue your path forward, armed with insights from professionals who prioritize your relocation journey and financial well-being.

Disclaimer: This information is provided for general informational purposes and shouldn't be taken as legal, financial, or tax advice.

We aim to keep everything accurate and up-to-date, but please bear in mind that tax regulations and laws have a knack for changing – plus, they can vary based on where you are and your circumstances.

Our suggestion? If tax decisions are on your horizon, especially those involving a potential move to Portugal, we strongly recommend contacting the seasoned tax professionals and legal experts at moviinn. It's always wise to have the pros in your corner.